portland or sales tax rate

6 5 to the City general fund. The average cumulative sales tax rate in Portland Oregon is 0.

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Portland Oregon and Austin Texas.

. The current sales tax rate in Oregon OR is 0. Multnomah County Business Income Tax rate. 2022 Cost of Living Calculator for Taxes.

The sales tax in Portland Oregon is currently 75. There is no applicable city tax or special tax. There is no applicable city tax or special tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The companys gross sales exceed 100000 or. What is the sales tax rate in Portland Indiana.

1 to Travel Portland Multnomah County. Portland Clean Energy Initiative. The current total local sales tax rate in Portland TN is 9250.

The 8 sales tax rate in Portland consists of 65 Arkansas state sales tax and 15 Ashley County sales tax. The minimum combined 2022 sales tax rate for Portland Indiana is. The 925 sales tax rate in Portland consists of 7 Tennessee state sales tax and 225 Sumner County sales tax.

City of Portland Transient Lodgings Tax. Despite the lack of a state sales tax Oregon was named one of Kiplingers Top 10 Tax-Unfriendly States for Retirees in 2011 for. This is the total of state county and city sales tax rates.

This includes the rates on the state county city and special levels. The company conducted more than 200. Hotel Motel and Short-term Rental Transient Lodgings Taxes.

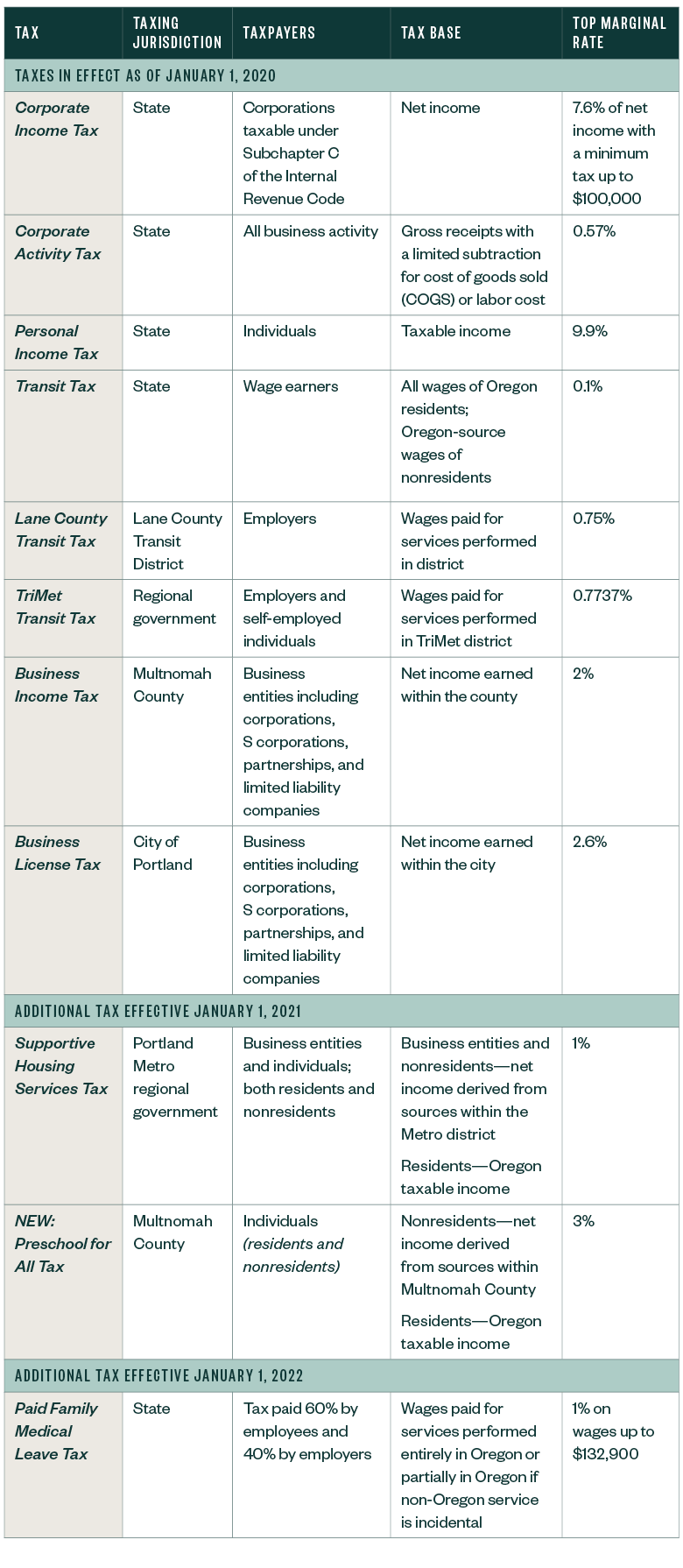

City of Portland Business License Tax rate. Arts Education and Access Income Tax Arts Tax Business taxes for Portland and Multnomah County. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

There are a total of 62 local tax jurisdictions across the state collecting an average local. The local sales tax rate in Portland Indiana is 7 as of September 2022. The County sales tax.

This is the total of state county and city sales tax rates. Portlands local sales tax jurisdictions are made up. Business Tax Rates and Other FeesSurcharges Business Tax Rates.

Method to calculate Portland sales tax in 2022. The Tennessee sales tax rate is currently. Exact tax amount may vary for different items.

Portland has parts of it located within Clackamas County. There are ten additional tax districts that apply to. 4 rows Portland OR Sales Tax Rate The current total local sales tax rate in Portland OR is.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local. There are no local taxes beyond the state. The Oregon sales tax rate is currently.

The December 2020 total local sales tax rate was also 8250. Special taxes such as. If approved the sales and use tax referendum would establish a uniform sales tax rate of 275 percent within the city of Portland except where the sales tax rate is limited or.

For example under the South Dakota law a company must collect sales tax for online retail sales if. This is the total of state county and city sales tax rates. The state sales tax rate in Oregon is 0000.

The sales tax jurisdiction name. The minimum combined 2022 sales tax rate for Portland Tennessee is. The current total local sales tax rate in Portland TX is 8250.

This rate is made up of a 65 state sales tax and a 10 local sales tax. You can print a 8 sales tax. The December 2020 total local sales tax rate was also 9250.

2022 Oregon state sales tax. Sales tax region name. Tax rates last updated in January 2022.

Portland Tourism Improvement District Sp. The minimum combined 2022 sales tax rate for Portland Oregon is.

High Earners In Portland Area Navigate Confusion Over New Personal Income Taxes Kgw Com

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Oregon Sales Tax Rates By City County 2022

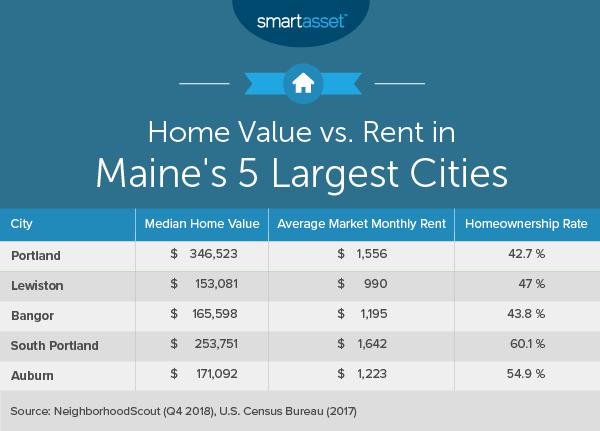

What Is The Cost Of Living In Maine Smartasset

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Maine Sales Tax Rate Remains Unchanged In Face Of Political Turmoil Avalara

Solved 4 Marks Melbourne Ltd Owns 100 The Share Capital Of Portland Ltd The Income Tax Rate Is 30 The Following Transactions Took Place During Course Hero

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Sales Taxes In The United States Wikipedia

New Portland Tax Further Complicates Tax Landscape

Tax Guide Best City To Buy Legal Weed In California Leafly

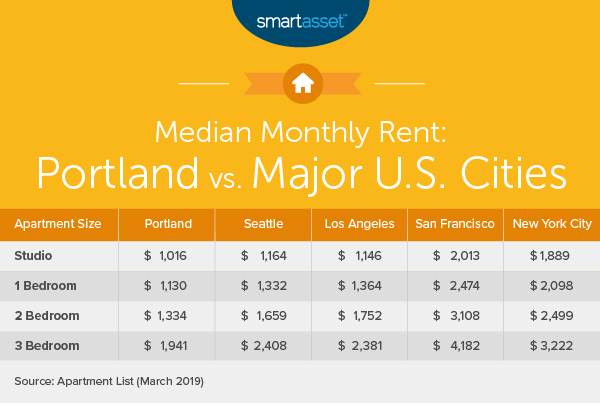

Cost Of Living In Portland Oregon Smartasset

What Is Subject To Sales Tax What Is Excluded In Washington State Asp

What Living In Portland Is Like Is Moving To Portland A Good Idea

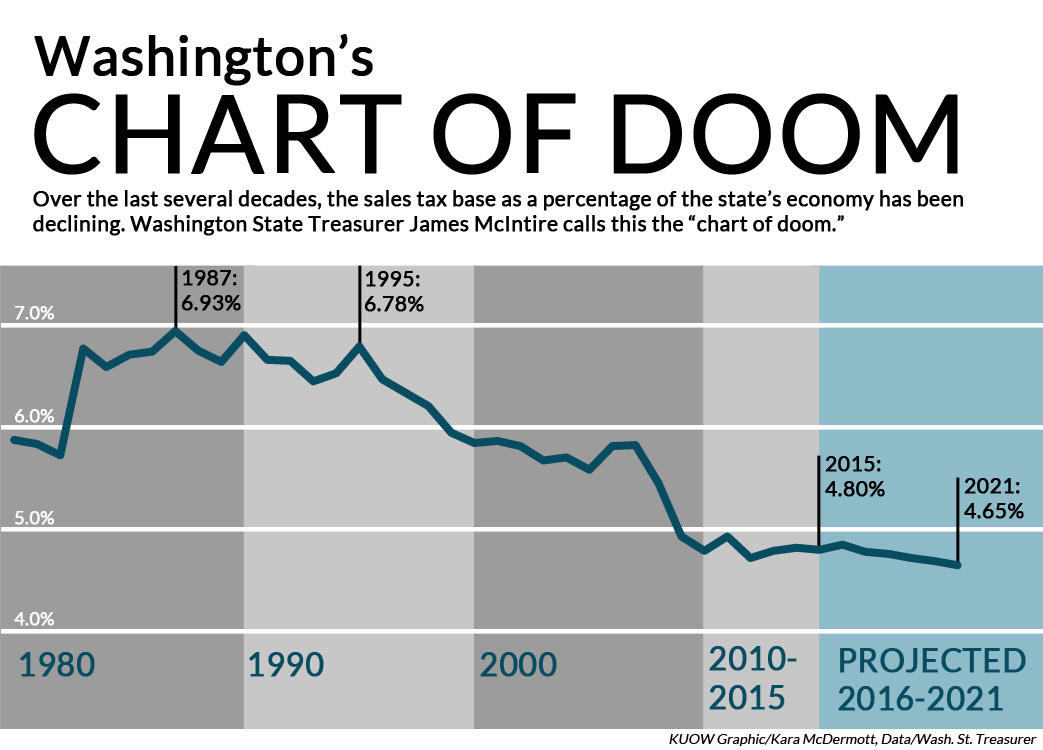

Washington And Oregon Have A Tax Off Who Wins Kuow News And Information

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

Multnomah County Business Income Tax Changes For Ty2020 Business Taxes The City Of Portland Oregon

Cost Of Living In Portland Or 2022 Is Portland Affordable Guide